Bridging the Gap: A Concerning Reality in Wealth Management & How We’re Uniquely Positioned to Fix It

There’s a concerning truth in today’s wealth management landscape that goes like this:

Clients partner with advisors and firms - oftentimes, some of the biggest names in the industry - with the expectation that they’ll receive top-notch, comprehensive care and service.

Unfortunately, as time goes on, they come to realize there is a significant disconnect between the services they expected to receive and the services they are actually receiving.

And, this gap isn't just a matter of client satisfaction - it represents real risks to families' financial wellbeing and long-term security.

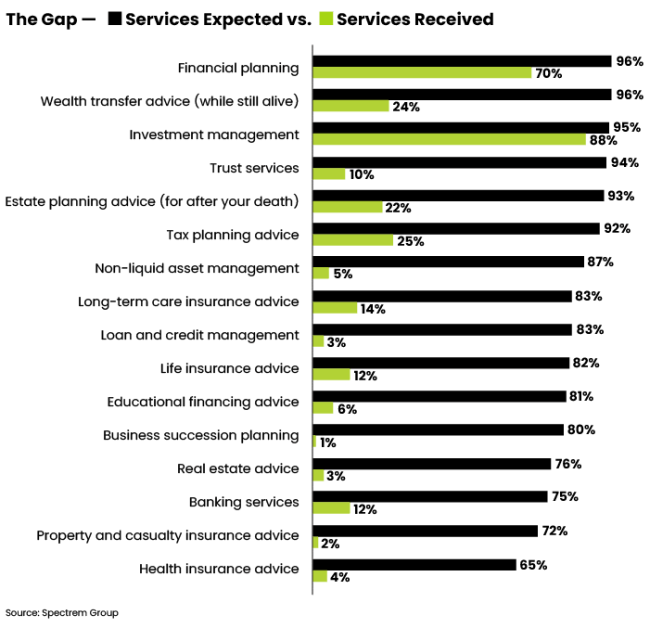

And, research from the Spectrem Group illustrates just how common - and concerning - these disparities are:

- 96% of clients expect comprehensive financial planning → But, only 70% receive it

- 94% of clients seek trust services → But, merely 10% get this critical support

- 93% need estate planning guidance → But, just 22% receive proper advice

- 96% want wealth transfer guidance during their lifetime → But, only 24% have access to it

Unfortunately, these figures aren’t just statistics - they represent real families facing real financial vulnerabilities, many of which they may not even be aware of.

Let’s take a closer look at what this means for your clients and how Entrust Wealth Partners works differently to close this gap for the individuals and families they support.

The Real Impact on Your Clients

The service gap in wealth management creates several critical risks that directly threaten the individual and family wealth and financial security of your clients:

- Incomplete Estate Planning: According to a 2023 Cerulli Associates study, 56% of high-net-worth families have outdated estate plans that don't reflect current tax laws or family circumstances. Without proper coordination between financial planning and estate strategies, families face:

- Increased estate tax exposure (potentially up to 40% of taxable estate value)

- Unprotected assets in case of incapacity

- Complex probate issues that can tie up assets for years

- Unintended inheritance outcomes

- Wealth Transfer Failures: Research from the Williams Group reveals that 70% of wealthy families lose their wealth by the second generation, and 90% by the third. Key factors include:

- Missed opportunities for tax-efficient gifting strategies

- Lack of coordination between investment and estate planning

- Insufficient preparation of next-generation family members

- Absent or inadequate family governance structures

- Tax Inefficiency: A comprehensive PWC study found that uncoordinated financial advice leads to:

- Missed tax-loss harvesting opportunities (average cost: 1-2% annual return)

- Inefficient asset location across accounts (potential impact: 0.25-0.75% annually)

- Suboptimal retirement withdrawal strategies (potential impact: up to 33% of retirement wealth)

- Missed charitable giving strategies that could reduce tax burden

- Investment-Estate Planning Misalignment: According to Ernst & Young, up to 40% of trust structures have investment policies that conflict with their estate planning purposes, potentially negating intended tax benefits or wealth transfer goals.

Why Some of The Biggest Names In Wealth Management Are Failing Clients

The wealth management landscape is dominated by large firms whose structure and business models create inherent service gaps. According to Fidelity research, 73% of firms lack critical expertise in advanced planning areas, while McKinsey data shows the average advisor manages over 200 client relationships and spends 80% of their time solely on investments.

This traditional model creates several fundamental problems:

- Revenue-Driven Service Gaps: Large firms' AUM-based revenue models prioritize investment management over comprehensive planning. Client needs in areas like estate planning, tax strategy, and risk management become secondary considerations.

- Disconnected Expertise: Most firms operate in silos, with separate departments for investments, planning, and trust services. This fragmentation leads to uncoordinated advice and missed opportunities for clients.

- Inadequate Resources: With advisors spread thin across hundreds of clients and lacking integrated technology (according to Cerulli, 65% of firms), consistent, comprehensive service delivery becomes impossible.

The Entrust Wealth Partners Difference

Today's complex financial landscape demands a fundamentally different approach - one where individuals and families have access to:

A unified team of experts working collaboratively on all aspects of their wealth

- Technology-enabled coordination of investment, tax, and estate strategies

- Regular, proactive monitoring of plan implementation

Clear accountability for plan coordination and comprehensive service delivery

At Entrust Wealth Partners, we've built our entire model around solving for these industry-wide vulnerabilities. It’s why we provide:

A dedicated team approach ensuring expertise across all planning areas

- Truly integrated service delivery and accountability, both internally and with external partners or other members of your advisory team

- Regular review cycles to identify new opportunities and potential risks

- Proactive communication to keep you informed and engaged

Technology that enables comprehensive oversight and coordination

We exist to eliminate the gap between what clients expect and what they receive. We believe wealth management should deliver on its promises, protecting and growing family wealth through genuine coordination and expertise. And, we’re committed to working with you to do just that.

Take Action

If you're unsure whether your current wealth management relationship is providing the comprehensive support you need, we invite you to schedule a complimentary Office Hour with Entrust Wealth Partners on March 10th or March 20th, 2025. During this session, we'll review your current plan and identify any gaps in your wealth management strategy.

Schedule Your Complimentary Office Hour with Keith

Schedule Your Complimentary Office Hour with Peter

Don't let gaps in wealth management service put your financial future at risk. Contact Entrust Wealth Partners today to experience truly comprehensive wealth management.